🤯 90 Surprising SaaS Market Statistics To Know in 2026

Share

Share

Get a quick blog summary with

We’ve researched and curated the latest SaaS market statistics to give you an up-to-date snapshot of the industry.

The latest data report shows explosive SaaS growth, with the industry expected to reach $317 billion in 2024 and $1.23 trillion by 2032.

From AI adoption to flexible pricing models, key trends are reshaping how SaaS companies scale and compete.

Whether you're launching a startup or leading an enterprise, these insights into SaaS growth, challenges, and opportunities will help you stay ahead in a fast-evolving market.

Top global SaaS market statistics at a glance

- 🌎 Global SaaS market to hit $317 billion in 2024 and $1.23 trillion by 2032.

- ☁️ Public cloud spending will reach $723.4 billion by 2025.

- 🛡️ 66% of organizations cite security as their biggest SaaS challenge.

- 🤖 52% of SaaS companies have integrated AI features.

- 🛒 44% of SaaS businesses now use usage-based pricing models.

- 🔄 30% of SaaS customers cancel subscriptions within the first 3 months.

- 📈 A 5% reduction in churn can boost profits by up to 95%.

- 🏢 Companies with over 1,000 employees use 177 SaaS applications on average.

- 📊 47% of companies lack resources for effective SaaS management.

- ☁️ By 2025, 85% of all business applications will be SaaS-based.

1. SaaS market size and growth trends

In this section, we’ll explore how the SaaS market has grown over time and where it’s headed.

You’ll see how adoption rates, revenue growth, and trends like public cloud spending are shaping the industry’s future.

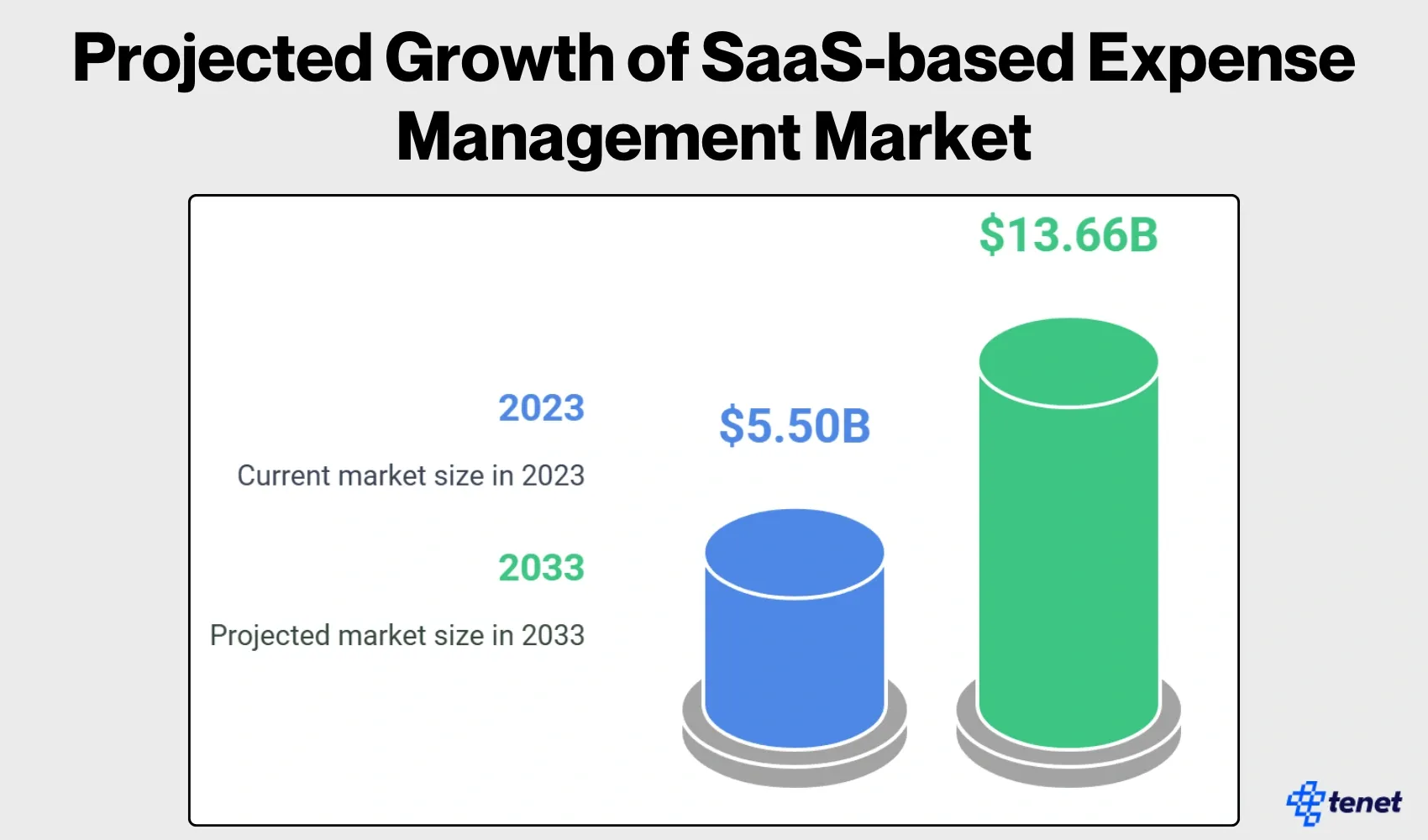

- The market is projected to grow from $5.50 billion in 2023 to $13.66 billion in 2033, representing a 9.2% compound annual growth rate (CAGR).

- The cloud application market has also shown consistent growth, rising from $30.3 billion in 2013 to a projected $168.6 billion in 2024.

- With an average compound annual growth rate (CAGR) of 25%, the SaaS market is expected to reach $317 billion by 2024.

- Projections indicate that the SaaS market will reach $1.23 trillion by 2032, reflecting the increasing adoption and reliance on cloud-based solutions.

- Public cloud spending is projected to reach $723.4 billion by 2025, underscoring the importance of cloud services in enterprise strategies.

Action item:

Audit your growth projections for the next 5 years. Ensure your business plan, infrastructure, and customer success operations are scalable enough to handle a 2x or 3x increase in user base as the market expands.

What it means for SaaS brands:

The expanding SaaS market lowers barriers for new entrants but raises expectations for rapid scaling. Brands must be ready to support large user growth without compromising service quality.

2. Regional market distribution

Ever wonder which parts of the world are leading the SaaS boom?

This section breaks it down for you, covering North America, Europe, and Asia-Pacific.

You’ll see who’s driving the most growth and how regional dynamics differ.

- North America

- The United States remains the largest SaaS market, growing from $108.4 billion in 2020 to a projected $225 billion by 2025.

- The US is home to approximately 17,000 SaaS companies, significantly outpacing any other country in the world.

- Canada follows with 992 SaaS companies, showcasing its growing influence in the sector.

- Europe

- Germany leads the European SaaS market with revenues of €6.85 billion, expected to grow to €16.3 billion by 2025.

- France is the second-largest SaaS market in Europe, growing from €4.75 billion to €11.05 billion by 2025.

- The annual growth rate for European SaaS markets between 2024 and 2029 is expected to be 19.14%, with a projected market volume of $190.80 billion by 2029.

- Asia-Pacific

- China’s SaaS market is expected to grow from $14.53 billion in 2024 to $37 billion by 2029.

- Japan’s SaaS market value reached an estimated ¥1.5 billion in 2023.

- India is rapidly becoming a major player, with its SaaS market projected to reach $50 billion by 2030, growing at a CAGR of 30-35%.

Action item:

Customize go-to-market strategies based on regional growth. For instance, double down on the U.S. but consider localizing product features and support for fast-growing markets like India, China, and Germany.

What it means for SaaS brands:

SaaS growth is becoming truly global. Companies that localize early — language, support, compliance — will outperform those relying solely on English-speaking markets.

3. SaaS adoption across industry verticals

Different industries have unique needs, and SaaS is meeting them in exciting ways.

Here, we dive into sectors like healthcare, finance, and education, explaining their growth rates and why they’re adopting SaaS at such high rates.

- The healthcare sector is valued at $51.7 billion, and it is projected to grow at a compound annual growth rate (CAGR) of 19.5%.

- The financial services industry is estimated to be worth $45.6 billion, with a CAGR of 16.2% over the coming years.

- Retail has reached a market size of $37.4 billion, experiencing significant growth at an 18.7% CAGR.

- The manufacturing sector is valued at $29.8 billion, and it is expanding at a CAGR of 17.3%.

- Education is a rapidly growing industry, worth $25.2 billion, with the highest CAGR of 20.1% in comparison to other sectors.

- The real estate market is currently estimated at $15.9 billion, with a growth rate of 15.8% CAGR.

- The legal industry is valued at $12.4 billion, with a steady growth rate of 14.5% CAGR.

- Hospitality is currently worth $9.7 billion, and it is growing at an impressive CAGR of 16.9%.

- The transportation sector is valued at $8.3 billion, with a strong 17.6% CAGR.

- The energy industry is estimated at $6.5 billion, experiencing a growth rate of 15.2% CAGR.

Action item:

Identify 1–2 high-growth industries (e.g., healthcare, education) and create specialized features or messaging tailored to those verticals. Consider building vertical-specific versions of your product.

What it means for SaaS brands:

Horizontal SaaS solutions are losing ground to vertical-specific platforms. The future is about serving deeply niche customer needs rather than offering broad, one-size-fits-all software.

4. Company usage patterns

How many SaaS tools does a business really use?

That depends on its size and experience with SaaS. This section looks at usage trends across startups, mid-sized companies, and enterprises, giving you a clear picture of what’s typical.

By company size

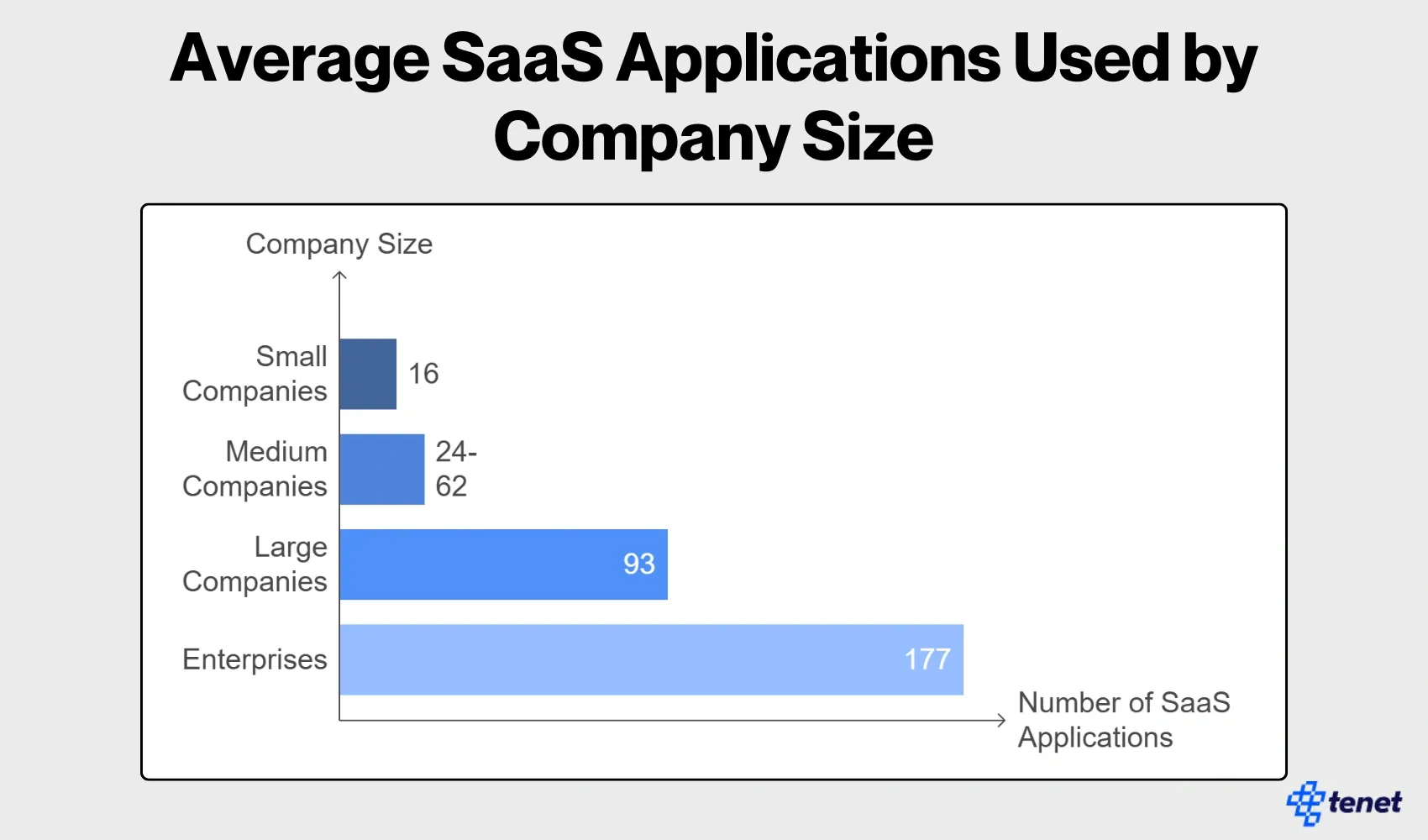

- Companies with fewer than 50 employees use an average of 16 SaaS applications.

- Medium-sized companies (50-499 employees) utilize 24-62 applications, depending on their scale.

- Larger organizations with 500-999 employees use around 93 applications.

- Enterprises with over 1,000 employees leverage an average of 177 applications.

The size of a company significantly influences the number of SaaS applications it uses, reflecting the complexity and scale of its operations.

By experience

- Companies with less than 1 year of SaaS adoption use an average of 14 applications.

- Those with 1-3 years of experience employ 49 applications.

- For companies with 4-7 years of adoption, the number increases to 108 applications.

- Businesses with over 8 years of SaaS experience use an average of 145 applications.

The length of SaaS adoption also plays a crucial role in determining how many applications companies integrate into their operations over time.

Action item:

Design product onboarding, pricing, and feature sets differently for SMBs, mid-market companies, and enterprises based on how many SaaS apps they typically use and manage.

What it means for SaaS brands:

Smaller companies want simplicity and low overhead. Enterprises demand integrations, APIs, and security layers. One product experience cannot fit all customer segments anymore.

5. Security & compliance

Learn the challenges companies face, from misconfigurations to compliance risks. You’ll also learn what organizations are doing to keep their SaaS environments secure.

- Misconfigurations are the root cause of 63% of all security issues within SaaS environments, highlighting the critical need for proper configuration management and monitoring.

- Security remains the largest challenge for 66% of organizations, emphasizing the ongoing struggle to protect sensitive data and ensure secure operations in cloud-based environments.

- Around 37% of companies express concerns about the security of their SaaS stack, indicating that a significant portion of businesses are actively considering the vulnerabilities inherent in cloud solutions.

- Encryption is a significant concern for 38% of organizations, underscoring the importance of ensuring data protection during storage and transit to prevent unauthorized access.

- 34% of companies worry about the impact of unsanctioned applications on compliance, stressing the need for strict governance and control over the tools integrated into their SaaS ecosystem.

- Surprisingly, only 46% of businesses review their SaaS configurations on a monthly or less frequent basis, pointing to a gap in proactive security management and the need for more regular audits to identify potential vulnerabilities

Action item:

Make security and compliance visible on your website — certifications, encryption standards, audit policies. Invest in regular third-party audits and publicly share results.

What it means for SaaS brands:

SaaS buyers are scrutinizing vendor security more than ever. Brands that prove their security standards upfront will build faster trust and close deals quicker.

6. AI and technology integration in SaaS

AI is everywhere in SaaS now, and it’s changing the game.

Here, we will look at how companies are using AI for automation, generative tools, and deep learning. It’s all about making SaaS smarter and more efficient.

- Over half (52%) of SaaS companies have integrated AI features into their offerings as of 2024, showcasing the rapid adoption of artificial intelligence across the SaaS sector.

- 38% of SaaS companies have implemented generative AI capabilities, reflecting the growing trend of using advanced AI models for content creation, problem-solving, and automation.

- 64% of organizations are focused on automating management tasks with AI tools, indicating a clear trend toward improving operational efficiency and reducing manual intervention through intelligent automation.

- 15% of SaaS companies have launched deep learning products to enhance their offerings, highlighting the industry's push toward leveraging advanced machine learning techniques for improved functionality and value.

- The AI market is expected to grow from $73.8 billion in 2020 to a staggering $1.5 trillion by 2030, reflecting the accelerating impact of AI technologies across industries and sectors.

- The global AI SaaS market is projected to grow at a CAGR of over 37% from 2023 to 2030, underscoring the immense potential and demand for AI-driven solutions in the SaaS space.

Action item:

Launch at least one AI-powered feature in your product this year — whether it’s predictive analytics, AI-driven personalization, or automated workflows.

What it means for SaaS brands:

SaaS without AI will feel outdated by 2026. Users expect smarter, faster, context-aware solutions, not just static software.

7. Financial metrics

Revenue & Pricing

Pricing can make or break a SaaS business. In this section, we’ll explore how companies are experimenting with models like usage-based pricing and why small pricing tweaks can lead to big profits.

- 44% of SaaS companies employ usage-based pricing models, reflecting the growing trend of aligning pricing with customer usage to drive profitability.

- A mere 1% improvement in price optimization can result in an 11.1% profit increase, underscoring the significant impact that small pricing adjustments can have on overall business profitability.

- 41% of SaaS companies utilize value-based pricing, which ties the cost of services to the perceived value provided to customers, enabling businesses to capture higher revenue based on the outcomes delivered.

- 82% of companies prominently showcase their pricing on their websites, ensuring transparency and helping potential customers make informed decisions based on clear SaaS cost structures.

- 38% of companies adopt a competitor pricing strategy, reflecting an approach where pricing is influenced by the rates charged by competitors, aiming to remain competitive within the market.

- 81.2% of participants believe that offering flexible payment options could reduce churn, indicating that adapting pricing flexibility can enhance customer retention by making services more accessible and affordable.

Action item:

Test flexible pricing models — such as usage-based or outcome-based pricing — in controlled experiments to improve revenue without massive customer pushback.

What it means for SaaS brands:

Static monthly plans are becoming outdated. SaaS companies that offer flexible, scalable pricing aligned to customer success metrics will enjoy better margins and retention.

8. SaaS adoption across industry verticals

Want to know where the money is flowing? This section highlights recent investments in SaaS, from major AI projects to niche platforms.

You’ll see which companies are attracting attention and why investors are excited about this space.

- In 2023, 47% of all venture capital funding was allocated to SaaS startups, reflecting the sector's strong appeal and growth potential for investors.

Major investments in 2024 included:

- OpenAI secured a groundbreaking $10 billion investment, highlighting its significant role in advancing AI technologies and its integration within SaaS offerings.

- Wiz, a leader in cloud security, raised $1 billion, underscoring the growing demand for innovative security solutions in the SaaS space.

- Clio, a provider of legal practice management software, attracted $900 million, further solidifying the expansion of SaaS solutions in niche industries like legal tech.

- Figma, a popular collaborative design tool, received $415 million, reinforcing the shift towards SaaS-based creative and design platforms.

- Perplexity AI, a rising star in the AI-driven SaaS market, secured $63 million, emphasizing the increasing interest in generative AI solutions within SaaS.

👉 SaaS UX design best practices to improve user experience and conversions.

Action item:

Analyze investor interest areas (AI, cybersecurity, vertical SaaS) and position your brand narratives and pitches around the themes venture capitalists are funding most.

What it means for SaaS brands:

Securing investment in 2025 is about aligning with the right trends — not just product excellence. Storytelling around AI impact, vertical depth, or security advantages will matter.

9. Customer acquisition, retention, and churn in SaaS

Customer retention is a challenge for any SaaS company, especially early on.

Here, we’ll discuss why churn happens, what businesses are doing to improve retention, and how long sales cycles affect customer acquisition.

- 30% of customers cancel their SaaS subscriptions within the first three months, indicating a critical early-stage churn risk that businesses must address to improve customer retention.

- For businesses earning less than $10 million, the average churn rate is a high 20%, suggesting that smaller companies face greater challenges in maintaining customer loyalty.

- On the other hand, companies with revenue exceeding $10 million experience a churn rate of 8.5%, demonstrating that larger companies with more resources tend to have better retention strategies.

- A 5% reduction in churn can significantly boost profits, with studies showing a potential increase of 25-95% in profits, highlighting the importance of churn management for SaaS profitability.

- The average B2B SaaS sales cycle lasts 134 days, underscoring the longer decision-making process typically involved in enterprise-level SaaS acquisitions, requiring businesses to maintain engagement and nurture leads throughout the cycle.

Action item:

Build early-stage customer success programs focused on onboarding, usage nudges, and value delivery within the first 30–60 days of subscription.

What it means for SaaS brands:

Winning the first 90 days of the customer lifecycle is critical. Brands that delay activation or first value realization risk losing users before they ever truly onboard.

10. Operations and management (SaaSOps)

Managing SaaS tools can get messy. Discover how companies are organizing their operations, adopting management tools, and overcoming challenges like troubleshooting third-party issues.

- 47% of companies report lacking adequate resources for effective SaaS management, pointing to a significant gap in operational readiness and the need for improved management capabilities.

- 64% of organizations plan to deploy dedicated SaaS management tools, indicating a growing recognition of the need for specialized tools to streamline SaaS operations and ensure better control over usage and costs.

- Half of all organizations aim to centralize SaaS management by 2027, highlighting a long-term trend towards consolidating and optimizing SaaS operations within companies to improve efficiency and reduce fragmentation.

- 73% of companies report challenges with third-party troubleshooting, suggesting that many businesses struggle to effectively resolve issues with their external SaaS providers, emphasizing the need for better vendor relationships and support structures.

- The average offboarding process for SaaS applications takes 7.12 hours, reflecting the time and effort required to properly remove users, secure data, and ensure compliance during the offboarding process.

Action item:

Integrate your product with popular SaaSOps and IT management platforms, making it easy for IT teams to centrally control user access, billing, and compliance.

What it means for SaaS brands:

If your SaaS doesn’t integrate well with company-wide SaaS management tools, it risks being seen as operationally expensive and harder to maintain, hurting your enterprise adoption potential.

11. Sales & marketing in SaaS

Sales and marketing take up a big chunk of SaaS budgets. Find out about how companies use strategies like content marketing and transparent pricing to attract customers and grow their brands.

- SaaS companies allocate an average of 50% of their revenue to sales and marketing, demonstrating the sector's focus on customer acquisition and brand growth.

- In the first three years of operations, this allocation increases to 75% of total revenue, reflecting the higher initial investment in marketing efforts to build awareness and grow the customer base.

- Content marketing is prioritized by 57% of SaaS companies, with an impressive 98% maintaining active blogs, underlining the importance of educational content and thought leadership in driving engagement.

- Buyers spend 27% of their time researching SaaS products, highlighting the crucial role of providing informative and easily accessible content to guide potential customers during their decision-making process.

- Content marketing is a powerful tool, driving a 400% increase in lead generation, showcasing its significant impact on attracting and converting prospects into customers.

Action item:

Double down on educational content: detailed blogs, comparison guides, webinars, and playbooks that help buyers self-educate before they ever speak to your sales team.

What it means for SaaS brands:

80% of the buyer journey happens before sales contact. Brands that don’t "own" the research phase with great content will miss out on a serious pipeline.

12. Top SaaS market leaders and key players

Who’s leading the charge in the SaaS world?

Salesforce, Adobe, and other giants like ServiceNow and Intuit are at the top, collectively valued at over $1.3 trillion.

How are they shaping the future of SaaS and driving industry innovation?

- Salesforce leads the SaaS industry with a market capitalization of $281.98 billion, maintaining its position as the dominant player in cloud-based CRM and enterprise solutions.

- Adobe follows closely with a market capitalization of $243.4 billion, a testament to its strong presence in digital media and marketing solutions for businesses of all sizes.

- ServiceNow and Intuit have market caps of $232.0 billion and $181.0 billion, respectively, showcasing their strong footholds in enterprise automation and financial software solutions.

- The combined market value of the top 10 SaaS companies exceeds an impressive $1.3 trillion, highlighting the immense financial strength and growth potential of the SaaS sector.

Action item:

Map out how SaaS leaders like Salesforce and Adobe expanded — through ecosystem building, marketplaces, and partnerships — and find 1-2 moves you can replicate.

What it means for SaaS brands:

Building product features isn’t enough. You need to build ecosystems around your product — integrations, partnerships, communities — to drive long-term defensibility.

13. Future projections and trends in the SaaS industry

What does the future hold for SaaS?

Here, we have added insights on 2025 trends like AI integration, remote work tools, and centralized management, giving you a glimpse of where the market is headed by 2030.

- By 2025, 85% of all business applications are expected to be SaaS-based, reflecting the ongoing shift towards cloud solutions for increased scalability, flexibility, and cost efficiency.

- AI integration within SaaS platforms is projected to reach 60% by 2025, highlighting the growing importance of artificial intelligence in enhancing automation, personalization, and data-driven decision-making in the SaaS industry.

- The SaaS market volume is forecasted to reach an impressive $481.40 billion by 2029, indicating substantial growth and continued investment in cloud-based software solutions across various sectors.

- Remote work solutions are expected to account for $30 billion by 2024, underscoring the significant demand for cloud technologies that enable efficient remote work and collaboration in a hybrid work environment.

- Centralized SaaS management is anticipated to see 50% adoption by 2026, as organizations increasingly recognize the need for unified tools to streamline and optimize SaaS usage and governance.

Action item:

Create a future trends task force inside your company to monitor, test, and adapt your product or service based on emerging trends like decentralized SaaS or AI-driven low-code platforms.

What it means for SaaS brands:

The SaaS companies that adapt early to AI, remote work, and centralized operations will gain huge strategic advantages by 2027 — while slow movers will fade.

14. Resource utilization

- 50% of cloud budgets remain underutilized, leading to inefficiencies and missed opportunities for optimization within cloud-based operations.

- 76.5% of organizations express concern about the productivity impact of mismanaged SaaS tools, underscoring the importance of effective management to ensure maximum value from these solutions.

- 58% of businesses report a lack of adequate staff training and experience in SaaS management, highlighting the need for better skills and knowledge to effectively manage cloud resources and tools.

- A significant 94% of organizations agree that manual management processes result in poor decision-making, emphasizing the critical need for automation and advanced SaaS management tools to drive more informed and timely business decisions.

Action item:

Offer usage reports or cost optimization dashboards to your customers, helping them prove ROI internally and avoid budget cuts.

What it means for SaaS brands:

Proactive cost and value transparency will become a major differentiator in crowded SaaS markets. Helping customers justify your product protects against churn.

📊 Updated SaaS Market Statistics Summary

This is the latest updated (May 2025) statistics and insights on the SaaS market:

Running a SaaS business?

Here are ways we can help you start, grow, and market your SaaS brand:

- SaaS UI UX design agency

- UI UX Design Service

- Brand Research

- Digital solutions for the SaaS industry

- SaaS development company

- iOs app development company

- Android app development company

What’s Next for SaaS Market Industry (2025–2027)

Over the next two years, SaaS will shift from simply being “cloud-based software” to becoming AI-native, verticalized, secure, and financially flexible.

Here’s what to expect:

- AI Becomes Standard: SaaS platforms without embedded AI features will feel outdated by 2027.

- Rise of Vertical SaaS: Industry-specific tools will dominate horizontal platforms.

- Remote-First Workflows: Collaboration, async communication, and hybrid-ready platforms will drive massive SaaS spending.

- Embedded Finance: More SaaS apps will offer billing, payments, and credit inside their software natively.

- Zero-Trust SaaS: Security-first, identity-first architectures will replace simple password protections.

- SaaSOps Dominance: Enterprises will increasingly require centralized SaaS management for procurement, security, and governance.

Data sources

- Gartner, gartner.com

- BetterCloud, bettercloud.com

- Apps Run The World, appsrunetheworld.com

- IDC, idc.com

- Harvey Nash Group, harveynashgroup.com

- Thales Group, thalesgroup.com

- Latka, getlatka.com

- Reply, reply.com

- Statista, statista.com

- Cisco, cisco.com

- McKinsey, mckinsey.com

- Business Today, businesstoday.in

- Zinnov, zinnov.com

- MacroTrends, macrotrends.net

- Cloud Wars, cloudwars.co

- HubSpot, hubspot.com

- Custify, custify.com

- OpenView Partners, openviewpartners.com

- Consainsights, consainsights.com

Get a free consultation call with our SaaS growth experts

Get a free consultation call with our SaaS growth experts

Got an idea on your mind?

We’d love to hear about your brand, your visions, current challenges, even if you’re not sure what your next step is.

Let’s talk