How Much Does it Cost to Develop a Mobile Banking App?

Share

Share

Get a quick blog summary with

Many tech teams underestimate how much features like biometric login, real-time alerts, or compliance can add to the final cost. This leads to budget overruns and project delays.

In this guide, we explain what affects the total cost—from $30,000 for a basic app to $300,000 for a full-featured, secure, and compliant solution.

You’ll see a clear breakdown by feature, platform, design, and security, so you can plan your app with confidence.

What is the cost of developing a mobile banking app in 2025?

The cost of developing a mobile banking app in 2025 ranges from $30,000 to $300,000. Basic apps with standard features cost closer to $30,000, while complex, custom-built apps with advanced security and extensive functionality can reach $300,000.

Key factors that impact the banking app development cost are app complexity, feature set, design, developer rates, and compliance.

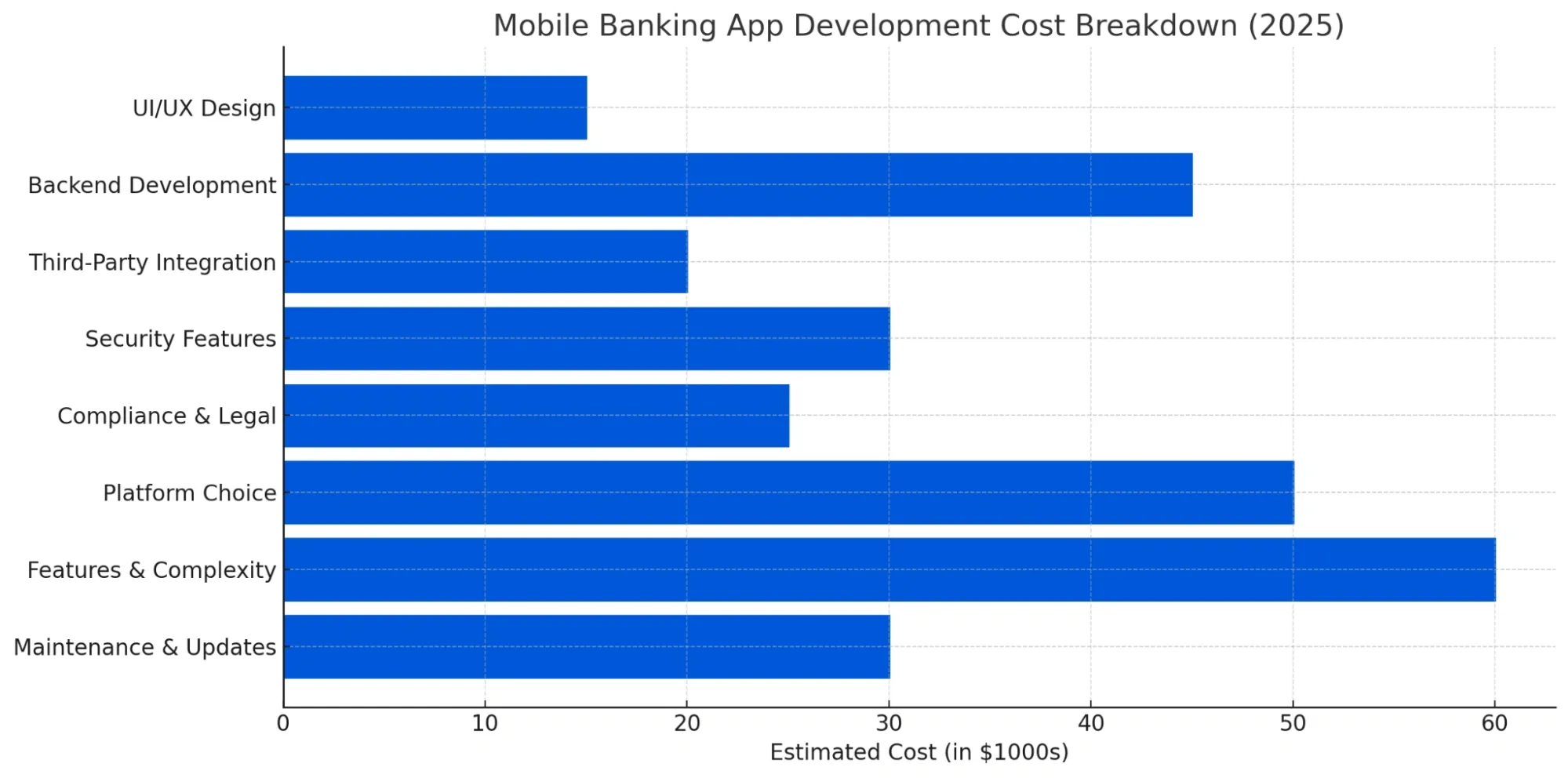

Here's a bar chart illustrating the estimated cost breakdown for developing a mobile banking app in 2025.

Each factor contributes differently to the overall mobile banking app development budget, with features and platform choice typically accounting for the largest shares.

👉 For a more detailed breakdown of general mobile app development costs, check out our comprehensive guide.

Explore our related services for your banking app design and development:

Mobile banking app development cost breakdown (With key factors)

Before you start creating a mobile banking app, it is helpful to know what affects the total cost of developing it. There are some things that will make your app more expensive, while others can help keep the cost low.

Here are the main factors that can change how much you have to spend on your project:

1. UI/UX Design

The UI/UX design is about how your app looks and feels while in use. A simple, prepared design is cheaper as it takes less time to make. However, if you want a unique form, custom graphics, or smooth animation, it requires more design functions and testing, causing more costs.

Investing in a polished design helps to attract and maintain users, but more custom and interactive designs increase design hours and testing needs.

👉 To learn more about the best practices and trends in app design, read our in-depth articles on UI/UX design for mobile applications.

Impact on cost

High for custom/animated designs due to additional work, and low impact on cost for standard layouts.

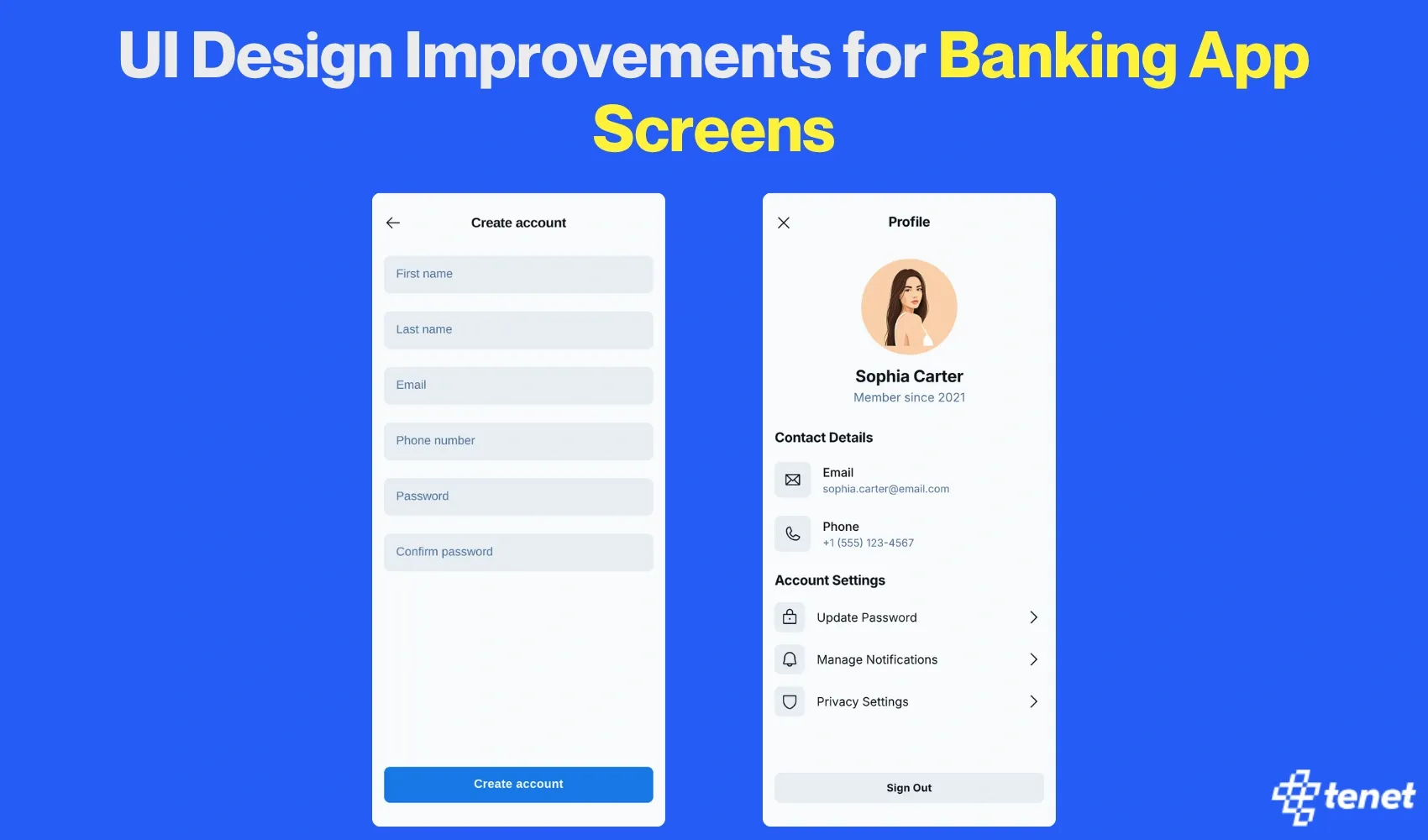

Here is a before-and-after banking app design that shows why great UI/UX may slightly increase development costs but dramatically improve user satisfaction and reduce redesign expenses later.

2. Backend development

The backend is part of the app that manages data and connects to the bank's system. If your app needs to show only the original account information, then it is simple and less expensive.

But if you want immediate transfers, notifications, or analytics, the backend will have to handle more tasks, which takes longer to make and test.

Impact on Cost:

Higher for complex backend (more features, more data handling); lower for simple, basic operations.

3. Third-Party Integration

A lot of apps need to be connected to other services, such as payment gateway or ID verification equipment. Each integration means additional work for developers to connect, test, and ensure that everything works smoothly.

In addition, many of these external services charge setup fees, use fee,s or ongoing membership costs. Therefore, the more third-party equipment you integrate, the more it adds to both your upfront development expenses and long-term operational costs.

Impact on cost

Higher with more integrations because of extra development and service fees; lower if few or no integrations are needed.

4. Security Features

Banking apps should have high security measures such as encryption and biometric login. Construction of such features is more time-consuming, and it needs experts, which increases expenses.

The more secure (such as multi-factor authentication or fraud detection), the more it will cost, since that requires additional coding, testing, and in some cases special tools or certifications.

Impact on cost

High when a high security is needed because of specialist work and testing; Low when less secure features are required.

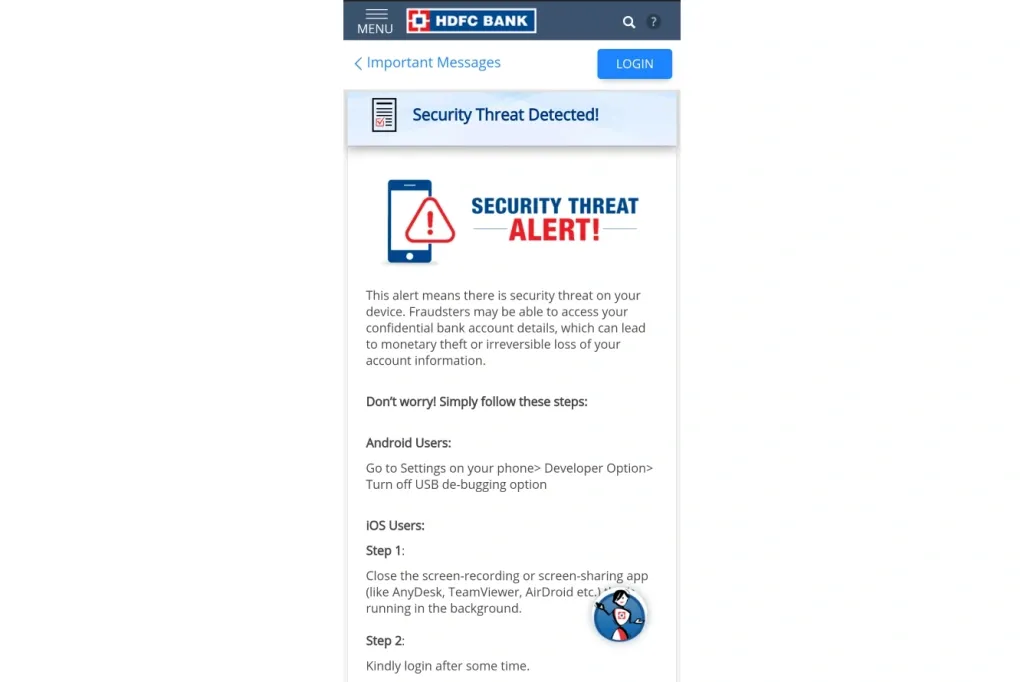

This is an example of an HDFC alert message, illustrating how built-in security features like fraud alerts add both value to user trust and complexity to development.

5. Compliance and legal

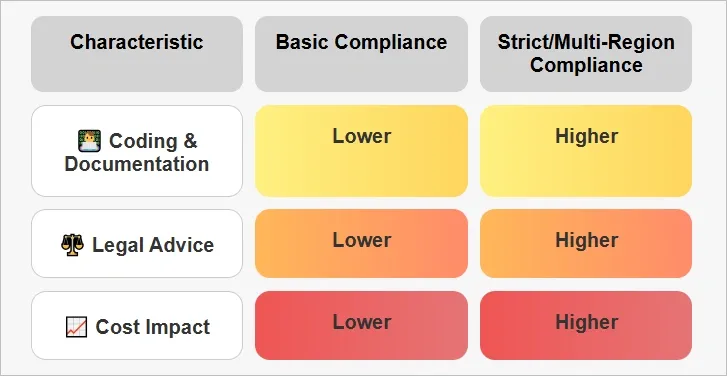

Banking apps should follow strict rules for the protection of user data. Completing these rules often means additional coding, documentation, and sometimes legal advice.

If your app should follow many rules & regulations or international standards to ensure everything is legal and safe, the cost increases due to additional work.

Impact on cost:

Higher for strict/multi-region compliance due to legal and technical requirements; lower for basic compliance.

Here is a chart showing the compliance impact on banking app cost, highlighting how stricter regulations and multi-region compliance lead to higher development expenses.

6. Platform Choice

The platforms you choose - iOS, Android, or both - have a direct impact on the development cost. Construction for both platforms means more time, effort, and coding because each has its own technology stack and design guidelines.

If you build for just one, the cost decreases because the work is cut in half. You can use a cross-platform framework such as Flutter or React native to develop for both at once, which saves money-but these can limit access to some platform-specific features or custom designs.

👉 For a real-world example, see how we developed a mobile app for both platforms in our Strongr case study.

Impact on cost

Higher for both platforms (more coding/design); lower for single-platform or cross-platform tools.

7. Features and Complexity

The more functions your application possesses, such as spending monitors, chat features or bill dividers, the longer it will take to create and test them all.

The basic apps that only have the essentials cost less. Each additional feature increases the price since it needs additional coding, design, and testing.

👉 To get the complete breakdown of the variance of features and functionalities on app budgets, refer to our Mobile App Development Cost Guide.

Impact on cost

Higher with more features (more development time); lower for basic feature sets.

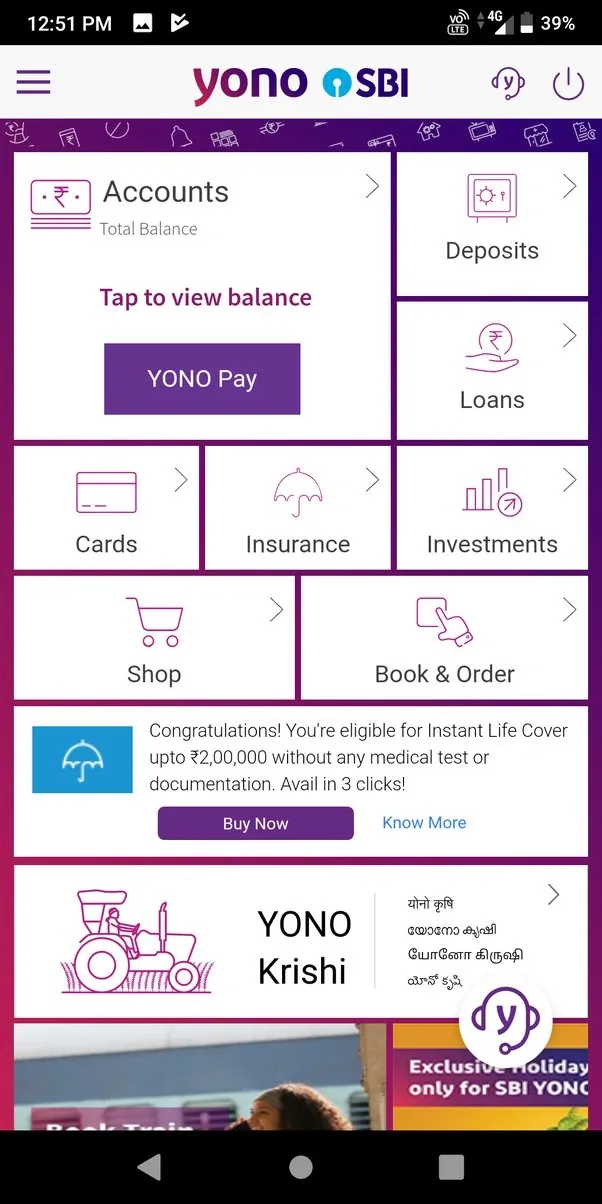

Here’s an example of a basic banking app.

In this image, the app has fewer features, a simple design, and yes, lower development costs. But it often leads to a poor user experience and lower customer trust.

More features mean more coding, design work, and testing, which increases the budget, but also builds a better product that users actually want to use.

8. Maintenance and Updates

After your app goes live, that is not the end of work. You’ll need regular updates to fix bugs, improve security, and add new features over time.

The more elaborate your application or the more frequently you intend to update it, the greater will be your maintenance costs. Usually, you should count on 15-20 percent of your initial development fee annually, however, in case of feature-rich or regularly updated applications this figure may be even larger.

Impact on cost

Higher with frequent updates (more developer hours); lower if updates are rare or minimal.

Below is a chart showing the major factors influencing app development, clearly linking each one to how it affects your overall project cost.

This breakdown shows why app costs can vary so much. The more advanced the features and the stricter the compliance, the more you’ll need to invest, but it all comes down to what kind of experience you want to offer your users.

What are the must-have features to have in your mobile banking app?

1. User Registration & Profile Management

Customer registration and account settings allow users to sign up and maintain their personal information. The majority of banking applications allow registration using a mobile number, email, or Aadhaar.

After the login, users will be able to change their address, change their password, and select the notification options. This account security feature is significant, and it allows users to have control over their information.

Example:

On the HDFC Bank app, upon logging in using your mobile number, tap on your profile picture to add a new address, change your profile photo, and see your account summary, all under the heading of “My Profile”.

Here is a UI example of a profile and account creation screen of a banking app.

This image clearly highlights how a smooth onboarding experience builds trust and improves overall usability.

The image given below depicts the profile management part of the application, where a user is able to change personal information, modify address, add profile photo and manage account settings.

2. Secure Biometric Authentication

The biometric authentication enables users to use fingerprint or face recognition to access their accounts, and it is quick and safe.

When it is on, all you need to do is open the application and look or touch to get into your account; hence, there is no need to recall passwords. This aspect eliminates the possibility of unwanted access and assures the user that financial information is secure.

Example:

The mobile app of BOI (Bank of India) & HDFC allows you to activate the fingerprint or Face ID authentication in the application settings. The next time you open the app, just touch your fingerprint or look at your phone; there is no password to remember.

Here is an image of the fingerprint login option of the HDFC app, which makes it faster and secure to log in to their account.

3. Real-Time Account Overview

A real-time account overview displays your current balance, recent transactions and all the accounts linked together the moment you log in.

This way, it is convenient to monitor your finances and detect any suspicious activity. Having everything about your account on the dashboard enables one to keep track of where he spends, what he deposits and generally know his financial status without having to look in various menus.

Example:

SBI YONO app provides you with all the relevant information related to your savings, fixed deposit, and loan accounts, as well as your last five transactions on the homescreen, so that you can access them quickly.

In this picture, you can see the dashboard of the account of the SBI YONO app, which will show the balance, recent transactions, and deposits immediately after logging in to the account.

4. Instant Fund Transfers & Bill Payments

This feature would allow you to exchange money or pay your bills at the touch of a button - be it UPI (Unified Payments Interface), NEFT (National Electronic Funds Transfer), IMPS (Immediate Payment Service), and indeed direct bill payments.

All one has to do is insert the details or scan a QR code, verify with OTP or fingerprint, and that is it. It makes management of daily payments easy and secure without having to visit a branch or handle cash.

Example:

The Axis Bank app enables users to just simply tap on the option of sending money, select UPI or account transfer, fill in the details and make the payment within a few seconds. In the Bill Pay section, you are also able to pay your electricity or mobile bill.

5. Expense Tracking & Budgeting Tools

Expense tracking tools automatically categorize your expenditure into a certain category such as groceries, travel, or dining, and provide charts or summaries to assist users in managing their expenses.

The app allows users to set spending and monthly trend limits as well as receive notifications when they are about to exceed their predefined budget. This aspect would help a person in understanding their spending habits and make better choices on savings and spending.

Example:

The banking app of Kotak 811 has a feature called 'Spends', which categorises your expenses, provides a monthly trend, and allows you to fix a spending limit, thus keeping you on track with regards to meeting your budget.

6. Real-Time Fraud Alerts

If you have suspicious activity in your account, such as a large return or a transaction from a new location, banking apps immediately alert you. These alerts come as push notifications or SMS, so you can quickly confirm or block unauthorized transactions. This feature is important for protecting your money, and if something is unusual, it helps you to work faster.

Example:

HDFC Bank's app sends a quick alert if it detects a transaction from a new location or a large return, helping users to confirm or report any fraud or transactional issues.

7. Virtual Debit/Credit Cards

Virtual cards are like digital versions of your regular debit or credit card, which are designed for online shopping or contactless payment.

You can create it in the app, watch card number, expiration date and CVV, and start using it immediately. This feature adds facility and safety, especially for online transactions or while waiting for a physical card.

Example:

Axis Bank’s app lets you generate a virtual debit card immediately after opening your account. You can view the card number, expiry, and CVV in the app and use it for online purchases instantly.

A sample shows what the virtual card looks like on the mobile banking app

8. 24/7 Customer Support (Chatbot or Live Chat)

In-app chat support gives users instant help at any time. Users can ask questions, report issues, or get account help without needing to call or go to a branch.

Even the Chatbots present on the banking apps help answer common questions, while live chat can help users connect to a person in the bank for more complicated problems, making it easier for them to get the help they need on time.

Example:

In the SBI YONO app, tap “Help & Support” to chat with the virtual assistant or connect to a live agent for quick answers to your queries, like resetting your PIN or disputing a transaction.

Here is an image of SBI YONO’s virtual assistant:

Need experts to develop your mobile banking app? Get a free quote now

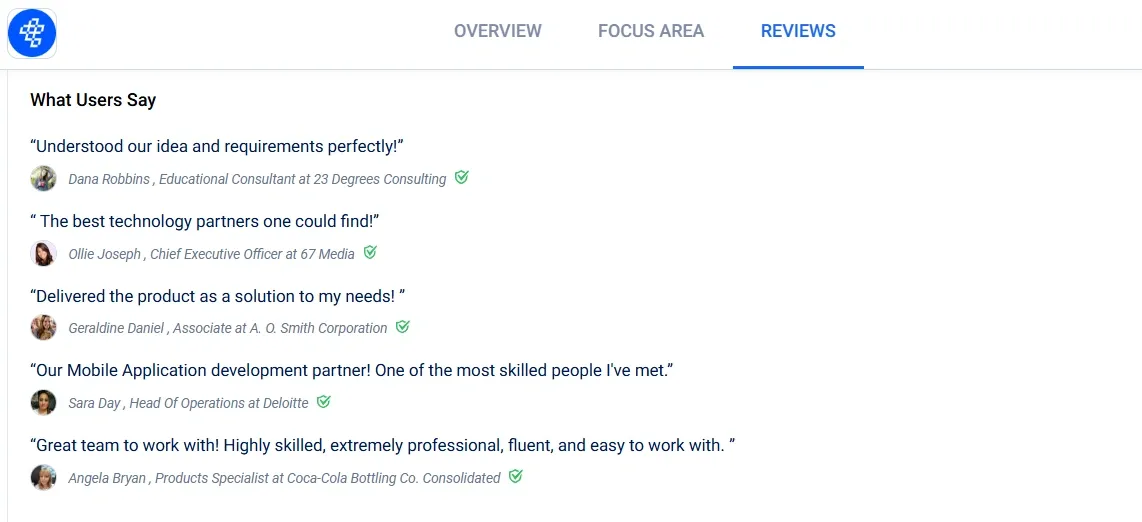

Tenet is a reliable digital product agency that has been selected by major financial organizations for safe, regulatory mobile banking app development. Our team focuses on security, compliance, and user-friendly design, which helps financial organizations to launch reliable apps.

Here’s how our customers describe working with us:

If you want to develop a mobile banking app that meets industry standards and is higher than user expectations, then Tenet is ready to help.

From the concept to launch, we guide you at every step with clear communication and commitment to your success.

👉 Request your free quotation today and do some extraordinary construction together.

FAQs

How much does it cost to create a mobile banking app like Chase?

Mobile banking apps such as Chase are usually formed between $ 50,000 and $ 300,000 or more, based on the complexity, features, and necessary integration of the application. This estimate covers design, development, testing, and integration with banking systems.

The high-end app with advanced security, analytics, and user experience features will be at the high end of the range.

What is banking app development cost like Natwest?

Developing a banking app similar to Natwest usually ranges from $ 70,000 to $ 150,000 for a medium-complex app, while highly advanced versions can reach $ 300,000 or more. The final cost depends on the facility list, technology stack, design, and development teams.

The cost of more complex applications is high, especially when they require intensive services and should meet strict compliance standards.

How long does it take to develop a mobile banking app from scratch?

A basic app may take 3 to 6 months, a medium-complexity app 6 to 9 months, and a highly complex app with advanced features may require 9 months or more. The timeline is going live, ranging from initial plan and design to coding, integration, testing, and end.

Therefore, the time to develop mobile banking apps from scratch varies from complexity.

Which factors affect the cost of developing mobile banking apps?

The main factors affecting mobile banking apps are the complications of integration features, app design, technology stacks, platform options (iOS, Android, or both), additional complications to meet strict safety and regulatory requirements, integration with developers' locations and rates, and integration with core banking systems.

Get expert help in designing & developing your mobile banking app. Free proposal.

Get expert help in designing & developing your mobile banking app. Free proposal.

Got an idea on your mind?

We’d love to hear about your brand, your visions, current challenges, even if you’re not sure what your next step is.

Let’s talk